This will determine the maximum number of shares of stock it would like to authorize. It will include this information in its charter or articles of incorporation. Overall, the number of shares outstanding, the metrics you can calculate from it, and related metrics — like the float — provide key insights to investors.

- It comes up with a set number of shares to divide the company into and can sell those shares as it sees fit.

- Once you have collected the total number of preferred shares, common shares outstanding, and treasury shares, you’re ready to do your calculation.

- Outstanding shares, or common stock outstanding, are the total amount of shares in a corporation that can be traded publically.

- These individuals have no real intention of selling the stock; if they do, they must inform the public of their decision.

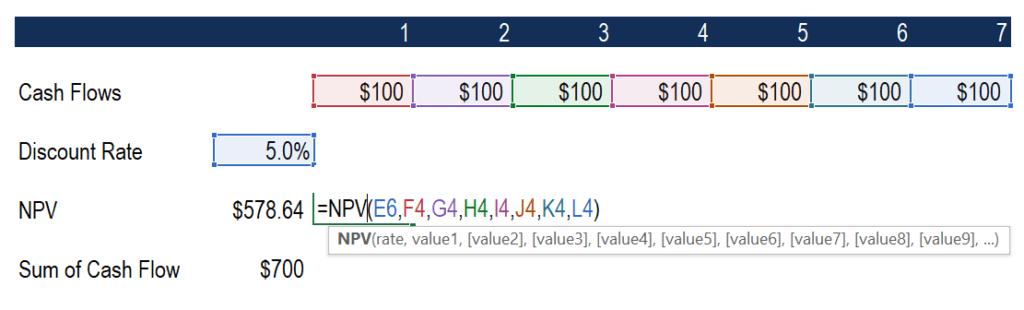

You can find a company’s earnings per share by dividing the company’s profit by its outstanding shares of common stock. You may be thinking to yourself – why do I care about learning how to calculate issued and outstanding shares; I know how many shares I own, isn’t that enough? While knowing how many shares you own is helpful, your company’s capitalization table (“cap table”) is critical when raising money and How to calculate shares outstanding understanding exactly how equity is allocated. Now, let’s imagine that you’ve obtained the company’s recent annual report, and you want to verify this number. In the equity section of the balance sheet, you might see common stock listed with a value like $1,000,000, and a note indicating that this represents 100 million shares. This confirms that there are indeed 100 million shares outstanding, as calculated.

FAQs on outstanding shares

The whole point of companies going public is to raise money and for investors to achieve financial gains. At the time, GE discussed plans to split into three companies and to divest from many businesses. They determined that reducing their share count from nearly 8.8 billion to roughly 1.1 billion better aligned with this vision (1). You can find shares outstanding at the top of a company’s 10-Q or 10-K filing. Importantly, the number of shares outstanding is dynamic and fluctuates over time. When you buy stock in a company, you are buying an ownership stake, which is issued as a share of stock.

Most companies include copies of their annual reports on their investor relations webpages. If I decide to split my company into 1,000 pieces, and then I sell all 1,000 pieces, I might not own my company anymore. So, the company will keep some of the shares and then issue the remaining shares for sale. So in the last example, instead of issuing all 1,000 shares for sale, I might only issue 400 shares of stock for sale, and I would keep the remaining 600 authorized shares of stock. Outstanding shares, or common stock outstanding, are the total amount of shares in a corporation that can be traded publically. This is important information to know for investors so that they have an idea of the true value and amount of tradeable shares there are in a given company.

How to Calculate Outstanding Shares

If the shares appreciate, the business makes a profit by investing in itself. Stock consolidations let a firm increase its share price without affecting existing shareholders or its market capitalization. This can help a firm avoid the appearance of its stock being a penny stock, a class of stocks that are known for higher volatility. Many stock exchanges also have minimum prices for shares to trade on the exchange, which consolidation can help a company reach.

Finally, and all the shoes that have been bought are like the outstanding shares. To understand an outstanding shares definition, one must first understand that not all stocks are traded publically. There are privately held shares of a company that can be only held by people within the company, and there are public shares. The total number of shares that can be traded publicly by any investor represents the outstanding shares. A reverse stock split exchanges existing shares for a proportionately smaller number of new shares. Companies may do this to increase their share price, such as if they need to satisfy exchange listing requirements or want to deter short sellers.

If that’s the case, congratulations, you don’t need to do any calculations. But usually you will need to pull several numbers from the balance sheet in order to calculate the total outstanding shares formula. A company’s number of shares outstanding is used to calculate many widely used financial metrics. Market capitalization — share price times number of shares outstanding — and EPS are both computed using a company’s number of outstanding shares.

Stock Splits

Thus, the denominator is expressed in terms of the type of common share that exists at the time the financial statements are released, rather than the type that exists when the earnings were achieved. Consequently, the treatment of stock dividends and splits is different from the treatment used for issuances of shares in exchange for assets or services. However, a stock dividend or split does have the effect of creating a new “type” of common share in the sense that the percentage of ownership per share is altered. Consequently, the generally accepted accounting principles (GAAP) require the use of an average number of shares outstanding as the starting point for all denominators. If shares have been reserved through your company’s stock incentive plan (“SIP”) or a stock option pool, but not yet allocated to an individual, they are considered reserved shares. It is advisable to carefully go through the company’s financials before putting your money in!

- In essence, the fully diluted number of outstanding shares tells us the number of shares outstanding there could potentially be.

- Out of these, 600 shares are issued as floating shares for the public, and 200 shares are issued as restricted shares to the company insiders.

- The number of shares outstanding decreases if the company buys back shares or a reverse stock split is completed.

- Keep in mind, other fees such as trading (non-commission) fees, Gold subscription fees, wire transfer fees, and paper statement fees may apply to your brokerage account.

While shares outstanding account for company stock that includes restricted shares and blocks of institutional shares, floating stock specifically refers to shares that are available for trading. Floating stock is calculated by taking outstanding shares and subtracting restricted shares. Restricted stock are shares that are owned by company insiders, employees and key shareholders that are under temporary restriction, and therefore cannot be traded. As noted above, outstanding shares are used to determine very important financial metrics for public companies. These include a company’s market capitalization, such as market capitalization, earnings per share (EPS), and cash flow per share (CFPS). The number of shares outstanding increases when a company issues additional shares or when employees exercise stock options.

Many companies decide to do a stock split to make their stock more affordable for a broader range of investors and to improve liquidity. The first of these, unrestricted shares, is also known as “the float.” These are the shares that can be actively traded on the open market. On the balance sheet, there is a line item description that states the number of shares outstanding.

Where to Find the Number of Shares Outstanding?

These companies aggressively fund their growth by using convertible debt and paying employees with stock incentives. By contrast, many older stalwart companies are likely to have a number of shares outstanding that matches its number of shares fully diluted. In the end, as the number of outstanding shares decreases by 1,000, the company’s EPS increases by 6.89%. The number of authorized shares can be substantially greater than the number of shares outstanding since authorized shares represent the maximum possible number of shares a company can issue. The outstanding number of shares may be either equal to or less than the number of authorized shares. For example, a company might authorize 10 million shares to be created for its IPO, but end up actually only issuing nine million of the shares.

Based on the given information, Calculate the number of shares outstanding of the company. In other words, shares outstanding indicates the number of shares of a company available at the open market. Over time, as a company issues more stock options, the firm’s total number of shares outstanding will increase due to employees exercising their options. The major difference between outstanding and issued shares is that outstanding shares are the shares available with the shareholder at a given period after excluding treasury shares.

Add the Preferred and Common Stock, Then Subtract the Treasury Shares

You will find the total number of outstanding shares listed on your company’s balance sheet under the “Capital Stock Issued and Outstanding” heading. You can also calculate the number of outstanding shares by adding the total number of preferred stock shares to the total number of common stock shares, and then subtracting the total number of treasury shares. Other methods for determining outstanding share totals include looking at the company’s market capitalization, earnings per share (EPS), or cash flow per share (CFPS). “Issued shares” are a company’s authorized shares that are sold to shareholders, including those sold and held by company founders and insiders, institutional investors, and the general public.

Outstanding shares are the total number of common stocks owned by investors. This 800 is divided into 600 (shares held by the public) + 200 (restricted shares held by company insiders). The total number of issued and treasury stock includes both common and preferred stock available in the company balance sheet. In the above example, if the reporting periods were each half of a year, the resulting weighted average of outstanding shares would be equal to 150,000. Thus, in revisiting the EPS calculation, $200,000 divided by the 150,000 weighted average of outstanding shares would equal $1.33 in earnings per share.

Advanced Drainage Systems, Inc. (NYSE:WMS) Shares Could Be 24% Above Their Intrinsic Value Estimate – Simply Wall St

Advanced Drainage Systems, Inc. (NYSE:WMS) Shares Could Be 24% Above Their Intrinsic Value Estimate.

Posted: Mon, 21 Aug 2023 11:16:24 GMT [source]

As such, you would calculate the common stock equivalency for purposes of determining the total number of shares issued. The actual amount of stock that is willing to sell is generally less than the amount authorized and is called issued stock. The issued stock that is sold and is held by stockholders is called the outstanding stock. The company can buy back any amount of outstanding shares, and this reacquired stock is then called treasury stock. You figure the amount of outstanding stock by subtracting the number of treasury shares from the number of issued shares.

Restricted shares are those issued to an insider that vest over time if that individual maintains their position with the company. Keep in mind, other fees such as trading (non-commission) fees, Gold subscription fees, wire transfer fees, and paper statement fees may apply to your brokerage account. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision.

Find the amount of total issued shares and subtract all the treasury shares, the stock the company buys back, to find outstanding shares. The number of outstanding shares determines the dividend per share (DPS). “Authorized shares” refer to the maximum number of shares that a company can issue as stated in the certificate of incorporation. They are established at the time the company is created and normally number in the millions. If the company has not bought back shares from investors and does not have treasury shares, this line item won’t show up on the balance sheet. Once you’ve located the number of treasury stocks, write it down for your calculations.

In the US, public companies are obligated to report their number of shares outstanding as part of the SEC’s filing requirements. Stocks that have a smaller float are generally more volatile than stocks with a larger float due to their limited availability. Investors may demand more shares than are available, resulting in the price of the shares increasing. The float gives valuable information to investors, like how a company may proceed in the future if it determines it needs more money or the ownership structure of the company. In this scenario, the company is trying to create an appearance of rapid growth in earnings per share to appear like a solid investment opportunity. A widely held opinion is that when these companies are repurchasing shares, they tend to do it when they have a lot of cash.

The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers shall be fully liable/responsible for any decision taken on the basis of this article. Want to put your savings into action and kick-start your investment journey 💸 But don’t have time to do research? Invest now with Navi Nifty 50 Index Fund, sit back, and earn from the top 50 companies.