Each employee is an additional $4/month for Core, $8/month for Premium, and $10/month for Elite. Contractor payments via direct deposit are $4/month for Core, $8/month for Premium, and $10/month for Elite. If you file taxes in more than one state, each additional state is $12/month for only Core and Premium. The discounts do not apply to additional employees and state tax filing fees. If you add or remove services, your service fees will be adjusted accordingly.

You get to automate and offload the full bookkeeping process.

During this process, you will be comparing all your transactions against all those recorded in QuickBooks. Sort your transactions by adding categories to them in the Transactions tab in your QuickBooks side menu. Select the box representing the connected bank or credit card you’ve connected to view your downloaded transactions. QuickBooks can automatically assign categories but for those labeled “Review,” you can assign a category by filling in the respective fields. After you process a customer payment, the next step is to mark it as paid by recording it in QuickBooks. You can record full or partial payments and QuickBooks tracks any balance.

How do I connect Amazon seller central to QuickBooks online?

While we don’t necessarily discourage you from setting this up yourself, why sganda doesnt always work the process can take quite a bit of time and effort. You would have to spend time learning the software and familiarizing yourself with all the settings. With a single click you can quickly see your profit & loss, balance sheet, and dozens of other reports. Sync data from popular apps like QuickBooks Time, Shopify, PayPal, and many others.

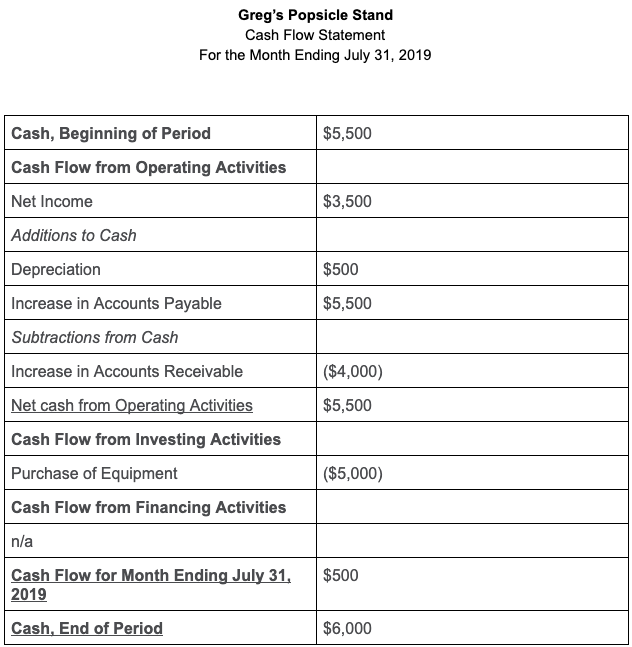

It’s just a matter of choosing one, setting up the integration, then getting someone to manage it (if you don’t want to do it yourself). You’ll have your Profit and Loss Statement, Balance Sheet, and Cash Flow Statement ready for analysis each month so a beginner’s guide to imputed income you and your business partners can make better business decisions.

- You can also count on Bench to help determine how much you should be paying in quarterly income taxes and sales tax, plus how to structure your business and expenses for optimum ecommerce tax deductions.

- Access valuable data on customer sales behavior that shows you popular products by region or season, and manage your inventory accordingly.

- After you process a customer payment, the next step is to mark it as paid by recording it in QuickBooks.

- However, even if small businesses are their forte, their software is flexible enough to cater to medium-sized businesses.

What Are the Benefits of Using QuickBooks for My Amazon Business?

The QuickBooks Online mobile companion apps work with iPhone®, iPad®, and AndroidTM phones and tablets. What you can sell depends on the product, the product category, and the brand. Some categories are open to all sellers, some require a revenue vs profit vs cash flow Professional seller account, some require approval to sell, and some include products that cannot be sold by third-party sellers. Reconciling is when you review your QuickBooks account and check if it matches your bank and credit card statements.

You can also group multiple payments into a single deposit. You can see your current inventory, get smart restocking alerts, and view insights on your products sold as well as expense insights. You can even enter non-inventory products and services. Simplify and automate sales tax calculations (GST, HST, PST, and QST) with QuickBooks.

Access valuable data on customer sales behavior that shows you popular products by region or season, and manage your inventory accordingly. We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month. Here are just a few of the reasons you may need a more robust ecommerce bookkeeping system. Income, expenses, outstanding invoices, and other key business financials are on view as soon as you sign in. Create invoices, take photos of receipts or see your company’s activities from the QuickBooks mobile app anytime, anywhere.

Enter custom tax rates and access reports on what you owe in real-time. You really need to set aside the time to make sure that you are recording entries and transactions almost as they come in. Otherwise, some are bound to slip through the cracks. At the very least, you could end up with incomplete records. This can, in turn, rob you of important deductions or make your business look less valuable than it really is. Automate your bookkeeping and save valuable time, effort, and ensure complete accuracy.