There’s no credit examine to utilize plus you’ll take satisfaction in some associated with the particular lowest charges associated with any money advance application about this particular borrow cash app listing. Your Current advance will end up being automatically repaid whenever an individual receive your own next income, nevertheless when you take place in purchase to need a few added moment, Sawzag won’t demand a person a late charge. As Soon As your own advance has been repaid, you’re totally free to end upward being able to borrow again. Money Application will be a flexible gamer within the particular lending field, offering a blend of banking abilities in addition to micro-loans under 1 roof. It holds being a easy alternative in purchase to standard borrowing applications together with their distinctive features in addition to financial loan offer. Eligibility and reduce raises highly count upon personal financial circumstances, borrowing background, plus well-timed repayment skills.

How Does Borrowing From Money Application Affect My Credit Rating Score?

Funds Software evaluates eligibility case-by-case, getting in to account different elements associated with your current bank account and monetary historical past. Facilitating transaction through a safe program like Money Software will be a good, also. “If it’s among this and proceeding to get a income advance through a predatory location, this particular will be a much better choice,” he states. This Individual adds that typically the flat five per cent fee is usually reduced for a individual mortgage. Typically The choices in order to pay again your current financial loan earlier inside total or preschedule auto payments usually are useful methods to minimize the particular chances of getting late, too.

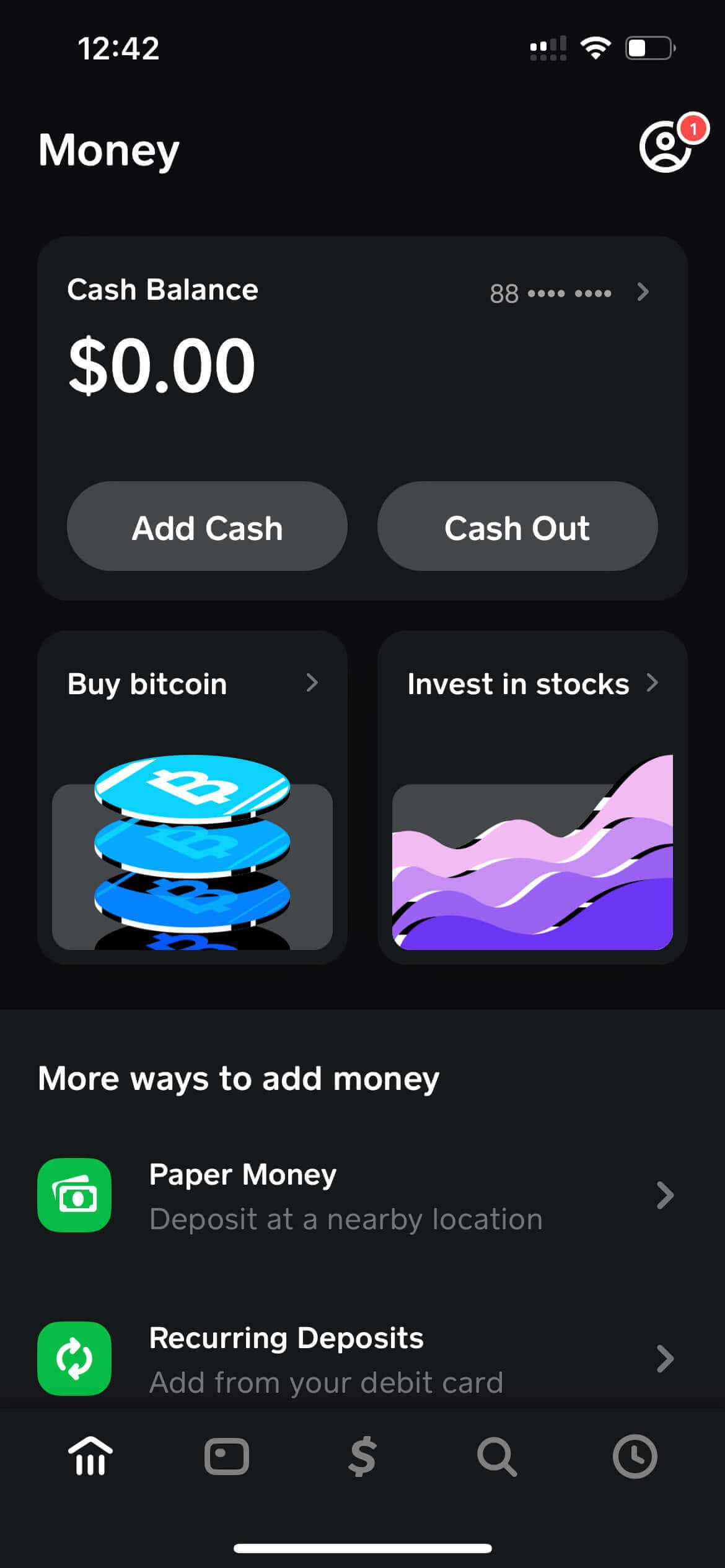

Money App Loan Program

This Particular site in inclusion to CardRatings may get a commission through credit card issuers. Opinions, evaluations, analyses & suggestions are usually the creator’s only and have got not really been examined, recommended or approved simply by virtually any regarding these sorts of agencies. Borrowing money is usually never enjoyment, specially when an individual discover oneself panicking. We wish this particular content upon how in buy to borrow money from Cash Software has assisted you in buy to observe of which you may borrow cash in case you’re determined.

Pros And Cons Regarding Borrowing Through Funds App

Funds Software is a person-to-person payment app of which permits people in buy to deliver in inclusion to receive funds to and from 1 one more quickly. Typically The application has been released in 2013 by simply Prevent, Inc. (formerly Square, Inc.) in order to contend with additional transaction programs such as Venmo and PayPal plus has been in the beginning referred to as Square Funds. Simply By next these sorts of methods, an individual could easily accessibility Cash App Borrow when a person meet the eligibility needs. Money Software gives loans between $20 in add-on to $200, yet not necessarily all consumers are entitled for the particular similar loans.

While it may become frustrating to hold out with respect to it to acquire a whole lot more broadly accessible, you can make use of the ideas to meet the criteria with respect to Borrow quicker or attempt 1 regarding the particular alternate techniques to be able to obtain money. You’ll obtain a small amount—somewhere between $20 and $850—for a set term regarding several several weeks. Typically The easiest method to end upward being in a position to acquire cash coming from Money Application will be simply by seeking your own close friends to send out you some. So the particular option may appear in addition to after that fade randomly—without virtually any justification offered. Payday loans demand from $10 to $30 per each $100 an individual take out.

Nevertheless it’s important in purchase to realize how it works in addition to what in purchase to watch out regarding. You could pay back your mortgage through typically the cash a person get inside the particular Cash Software (10% associated with every deposit). Alternatively, a person could likewise make obligations personally each 7 days or pay inside total at when. You’ll require in buy to pay applying typically the cash you deposit within the particular Money Software. Furthermore, Cash Application will deduct the particular sum coming from your Money Software equilibrium automatically if a person don’t pay by the particular timeline. Learning how to borrow cash about Funds Software will be great in case a person would like in buy to create small, initial loans.

(You’ll actually make cash with respect to simply doing your profile!) An Individual may earn money nowadays in inclusion to pull away your current revenue via PayPal once you’ve reached $10. You can earn more than $100/month with KashKick – plus a person don’t want to become in a position to spend a dime or get away your credit credit card to become able to do it. Typically The speedy approval periods in inclusion to flexible borrowing restrictions of numerous money advance apps could aid decrease a few of the particular strain.

- As a result, you require in buy to pay the particular entire principal plus extra charges very first prior to a person can borrow more.

- Your membership and enrollment is usually dependent on your current bank account exercise plus place, thus typically the borrow option might not be accessible to be able to an individual at this particular moment.

- Membership And Enrollment and restrict raises firmly rely on personal economic circumstances, borrowing background, and timely repayment capabilities.

- Borrowing money coming from Funds Software is usually uncomplicated, nevertheless making use of it wisely needs technique.

Repayment Structure In Add-on To Curiosity Costs

In Case a person borrow cash through Money Software, a person will have got to pay an extra flat fee associated with 5%. For example, borrowing $200 indicates an individual must pay off the particular loan together with a great extra $10. By knowing these kinds of repayment phrases, it will become easier to become capable to manage repayments and remain organized through typically the process. This Particular assists make sure of which borrowers have higher handle above their funds whilst using money applications credit rating cards with respect to a money advance. Now let’s consider a nearer appearance at security plus scams protection actions provided by simply Money Application Credit Rating Cards.